Personal loan servicing with Scratch

Scratch has reimagined loan servicing to help borrowers understand, manage, and pay back their loans. Why choose Scratch as your personal loan servicing partner?

.png)

Create a better experience for your borrowers

Your borrowers chose you for your streamlined, supportive, transparent origination experience. Why should their repayment experience be any different? Scratch extends your borrowers’ positive experience so they will remember you in the future and be more likely to refer you to their network.

Your borrowers can track and manage their loan progress in just a few clicks through the Scratch platform - anywhere, anytime. Borrowers can log in to Scratch to make payments, set up Autopay, view important documents, see real-time loan and payments information, and more.

People take on debt to get ahead, not to fall behind. As your servicing partner, we’re committed to helping your borrowers reach their goals – whether it’s renovating a home, planning for a special occasion, consolidating credit card debt, or covering an unexpected medical bill. Your borrowers can reach a Scratch Loan Guide in seconds via phone, chat, or email for personalized problem solving and empathetic guidance.

Enjoy a lender experience tailored for you

Our technology-first platform is built to support innovation – a must for personal lenders providing many types of loan products. Unlike most servicers, we're not limited by asset classes, features, or what's been done in the past. We’re ready to build custom features tailored to your products – like varying terms or flexible accommodation policies – and support your expansion into new asset classes – like private student loans.

With Scratch you’ll never have to wonder if your reporting is accurate — or when it's going to arrive. Our technology handles the complexities of loan accounting to give you accurate, daily insights into your portfolio via our SFTP or our reporting API. Beyond automated loan accounting, the Scratch platform applies the outcomes of any borrower’s life changes or loan updates real-time. No-interest forbearance? No problem. Your data will always be accurate, even when changes occur.

In an age of increasing competition, reducing the (historically inefficient) cost of servicing can make a real difference in helping you grow your business. Our technology automates the complexities associated with data, accounting, and compliance, so fewer costs are passed on to you as the lender. Scratch is committed to being an efficient and reliable servicing partner so you can put more resources into scaling your core business.

We're an end-to-end personal loan servicing you can trust

- Borrower inquiries via phone, email, and chat

- Delinquency management

- Collections until paid off or charged off

- Skip tracing

- Reporting to credit bureaus

- PACER, bankruptcy, OFAC, and SCRA monitoring

Download our fact sheet

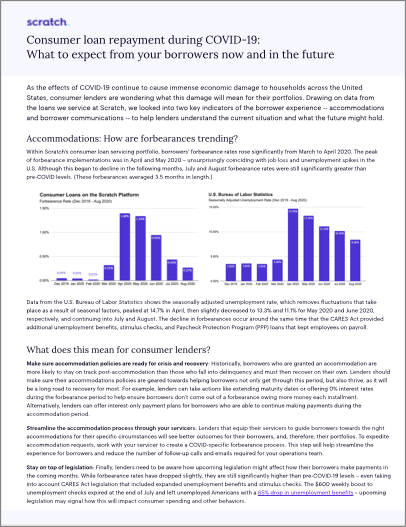

Consumer loan repayment during COVID-19

As the effects of COVID-19 continue to cause immense economic damage to households across the United States, we share our data on two key indicators of the borrower experience -- accommodations and borrower communications -- to help consumer lenders understand the current situation and what the future might hold.

Ready to get started with Scratch?

We are building new partnerships with personal lenders like you every day, and look forward to speaking. Get in touch with us through this form to start the conversation.